Email: doquangdatktvt@gmail.com

The global steel market rallied over the past month as disruption to the pig iron supply in Ukraine and Russia led to a spike in raw material costs.

Pig iron is one of the key raw materials in steel making, and Russia and Ukraine are both key suppliers. According to data from the Ukrainian steel association, Ukrmetallurgprom, Russia is the fifth largest pig iron producer by output volume, while Ukraine is ranked tenth.

Electric-arc furnace sheet mills in North America have relied heavily on the low phosphorus pig iron from Ukraine and Russia, according to industry publication the Steel Market Update (SMU).

Following the start of the Russia-Ukraine war on 24 February, imposed sanctions on Russia halted much of the country’s exports. Shipping disruptions in the Black Sea have cut off Ukraine’s pig iron exports.

Russia and Ukraine’s pig iron supplies account for 60% of US imports. Consequently, the supply cut from both countries has led to a surge in pig iron costs and higher steel prices. According to price reporting agency Argus Media, US steelmaker SSAB added a raw material surcharge on 9 March to reflect higher pig iron prices.

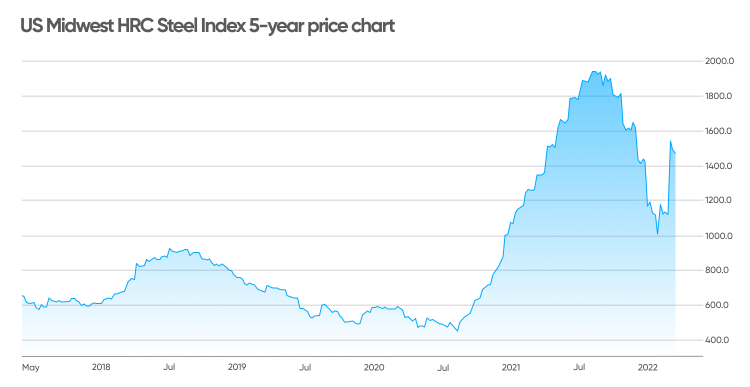

US HRC steel prices have been volatile since the start of the year. The May 2022 contract began the year at $1,165, and fell to a low of $935 on 27 January, before rebounding above $1,000 by late February.

According to the CME steel historical prices, HRC futures prices rose throughout 2021, peaking at a record high of $1,725 on 3 September. However, prices have been falling since the fourth quarter of last year as supply exceeded demand.

Following the invasion of Ukraine on 24 February, steel prices swung upwards on supply concerns. The March 2022 HRC contract traded on CME was at $994 on 24 February. The metal price spiked the following week to a one-month high of $1,175 on 4 March. Although prices have since fallen, they remain above the pre-crisis level.

Sanctions imposed on Russia have reduced the availability of steel in Europe. According to industry body the World Steel Association (WSA), Russia produced 75.6 million tonnes of crude steel in 2021, accounting for 3.9% of global supply.

Although Ukraine is still producing pig iron and steel, many steel mills and production facilities have been damaged or destroyed in the war.

According to the Ukrainian steel association Ukrmetallurgprom, Ukraine produced 1.79 million tonnes of pig iron and 1.85 million tonnes of steel in January. But with its Black Sea ports shut, the supply could not be exported.

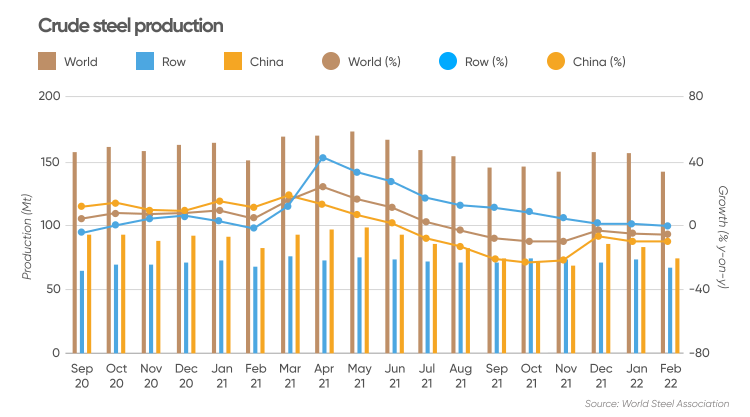

The crude steel output in the Commonwealth of Independent states region (which includes Belarus, Kazakhstan, Moldova, Russia, Ukraine and Uzbekistan) also fell to 16.8 million tonnes in January to February this year, down 1.7% compared with the same period in 2021.

With the uncertainty surrounding the conflict in Ukraine, the industry body IREPAS is expecting “the sanctions on Russia to remain in place for some time to come”, which is likely to support the steel market.

As part of China’s plan to decarbonise the economy, the Chinese government has implemented policies to cap steel production and emissions in 2021. Frank Zhong, deputy director general at the World Steel Association, wrote:

As a result of the emissions cap during the Winter Olympics in China, the country’s steel production continued to fall in January 2022. China’s crude steel output plunged by 11.2% year-on-year (YoY) to 81.7 million metric tonnes (MMT) in January, WSA data shows. The global output also fell by 6.1% YoY to 155 MMT in the first month of this year.

Data from China Iron and Steel Association also showed that production continued to fall in February to 59.4 MMT.

As a result of the uncertainty brought about by the Russia-Ukraine conflict and its related market volatility, many analysts are withholding their steel price projections and are only offering short-term analysis.

The European Steel Association (EUROFER) warned that while steel consumption is rising in Europe, industrial recovery is subject to considerable uncertainty due to the ongoing energy crisis. Axel Eggert, director general of EUROFER, said:

A technical analysis by MarketClub, it indicated a ‘weak downtrend’ for the HRC August 2022 contract:

When considering whether to invest in steel, you should always do your own research, considering the outlook and relevant market conditions. A number of factors dictate whether stock prices rise or fall, including the company’s fundamentals and broader macro-economic factors. There are no guarantees. Markets are volatile. You should conduct your own analysis, taking in such things as the environment in which it trades and your risk tolerance. And never invest money that you cannot afford to lose.

By : capital.com