Email: doquangdatktvt@gmail.com

Although there was a significant acceleration in production, iron and steel producers struggled to keep up with demand and burned through stockpiles.

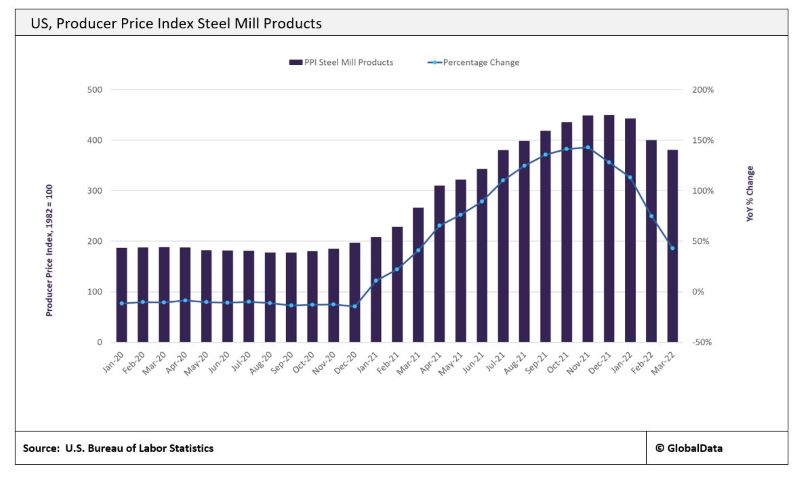

In the most recent figures published by the US Bureau of Labor Statistics, the Producer Price Index for Steel Mill Products dropped 4.9% in March 2022, marking the third month-on-month (MoM) contraction in the past three months. Upon re-opening the economy, the price of steel soared in 2021 as demand outpaced supply and the PPI for Steel Mill products peaked in December 2021, rising 128.0% year-on-year (YoY). In a rush to meet demand last year, firms rapidly expanded operations following a sharp slowdown in production in the first half of 2020.

Capital utilisation for iron and steel product manufacturing dropped to an all-time low of 52.6% in May 2020 at the height of the pandemic and by September 2021, this figure had risen to 85.1%. Although there was a significant acceleration in production, iron and steel producers struggled to keep up with demand and burned through stockpiles. After dropping to a two-year low, unfilled orders for iron and steel product manufacturing increased by 37.1% YoY to a ten-year high in July 2021.

In the latter half of 2021, the price of steel mill products stabilised and started to ease back in the first few months of 2022, as supply chain issues that plagued the market earlier in 2021 eased, thereby reducing pressure on prices. A rapid push to replenish stocks and an uptick in steel imports then led to an oversupplied market. According to the American Iron and Steel Institute, total steel imports rose 43% over 2021. Capacity utilisation relaxed towards the end of 2021 and into the new year, as capacity utilisation dropped to 77.2% in February 2022. However, unfilled orders climbed 2.0% MoM in January and February 2022, indicating steel manufacturers are still having issues with supplying the market, and supply difficulties remain an issue.

The steel industry is expected to face new challenges, and supply chain issues are likely to persist over the remainder of 2022. The advent of the Russian-Ukrainian war and the following sanctions have added to uncertainty and supply will consequently be restricted further, with 61% of US pig iron (key input for an Electric Arc Furnace) imported from Russia and Ukraine combined.

On the upside, the Biden administration decided to roll back Trump-era tariffs after the federal government reached agreements with the UK, EU, and Japan, among others, earlier this year. Additionally, new domestic capacity coming online in 2022, such as the Steel Dynamics (SDI) flat-rolled mill in Texas, will ease the pressure on supply.

Strong steel demand is expected to continue, as the Infrastructure Investment and Jobs Act (IIJA) is now in motion and ‘shovel ready’ projects will begin towards the end of 2022. Funding will be spent over the next ten years, including $550 billion in new spending over the next five years. As a part of the IIJA, new guidance on ‘Buy America’ shows that all federally-funded projects must source all the iron, steel, manufactured products, and construction materials used in the project from the US.

Although the price of steel has eased from the highs in December 2021, it is unlikely prices will drop to pre-pandemic levels and are likely to remain elevated as robust demand and restricted supply will carry steel price momentum over the remainder of the year.

By: Globaldata